Last month was a tough market for both equity and fixed income investors with the MSCI ACWI declining 0.1% and the major global fixed income index (ICE BofAML Global Broad Market) declining 0.5%. In particular, we saw a further decline in some of the large cap technology counters, including Tencent (-2.9), Alibaba (-5.9%) and Facebook (-7.6%). Year-to-date these companies have now declined between 15% (Facebook) and 34% (Tencent).

Fortunately, not all tech counters have been treated the same by investors with Microsoft, in particular, continuing its strong performance and now being up 25% year-to-date.

Sadly, earlier this week we heard about the passing of Paul Allen, co-founder of Microsoft. Paul, which was much lesser known than Bill Gates, was instrumental in shaping the company’s long-term fortunes. An interesting anecdote from his earlier life shaped the outcome of his fortune (estimated at $26 billion upon his passing).

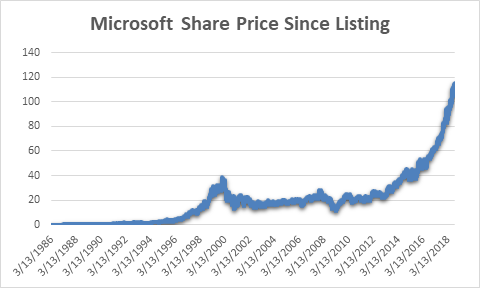

In 1983 Bill Gates offered to purchase Paul’s entire holding in Microsoft at $5 per share. Paul countered with a price of $10, which Bill declined to take up. Yesterday, Microsoft traded hands at $107. Not bad for a deal that fell through (from Paul’s perspective!). Above is Microsoft’s share price since Microsoft started trading in the US in 1986. We have adjusted the share price to take into account both share splits and scrip dividends.

t is worthwhile noting how volatile Paul’s ride has been. In spite of the sharp drawdown post the 1999 dot-com bubble as well as the 2007/2008 Global Financial Crisis, Paul kept his shares and reaped the rewards, which long-term investors in good, quality companies tend to enjoy. Investors who purchased Microsoft at listing, and maintained their shareholding, have enjoyed a 32-year compound annual return of 26.1% (an absolute return of 168,388%!)

During times of market volatility it is important to evaluate whether the underlying investment thesis for the holding has changed. If it has not, and the value of the holding remains intact, then it is worthwhile seeing out short-term market movements and remaining invested for the long-term. Exactly like Paul did. To this end, the Fintax Funds have held up well in a difficult market environment, and have continued to deliver an excellent long-term performance record since inception. The funds are also well-positioned to weather continued shorter-term market volatility with diversified, quality investment holdings.

As always, we welcome any questions, queries or comments you may have.