Market volatility has become heightened both in the lead up to the U.S. elections taking place in November, and the uncertainty of the interest rate reduction as inflation persists. Sector pricing dislocations have become a feature of the current market with the price of cocoa surpassing $10 000 a ton for the first time ever, bitcoin surpassing its July 2021 highs, and gold reaching new all-time high prices.

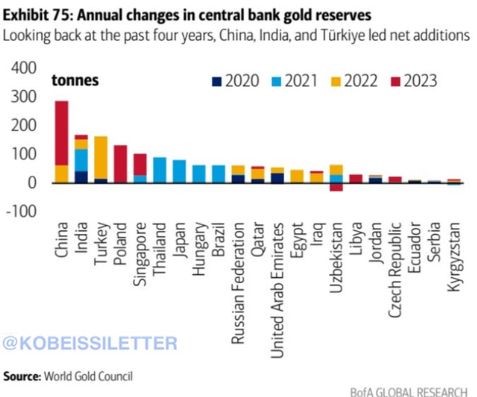

Consider the following; whereas the rally in the price of bitcoin (+163% over the prior one year) has become a feature of excess money supply and risk taking, counterintuitively, the gold price, a bastion of safety at the other end of the risk spectrum, has rallied at the same time (+18% over the prior one year), despite treasury yields remaining elevated. Strangely, both risk-on and risk-off assets have risen in-synch. Upon further investigation, the rally in the gold price may have less to do with excess money supply and more to do with China ramping up its gold reserves. Below is a graph showing how aggressive China been accumulating physical gold over the prior year.

Source: World Gold Council, Bank of America and Kobeissiletter. Data as of 31 December 2023

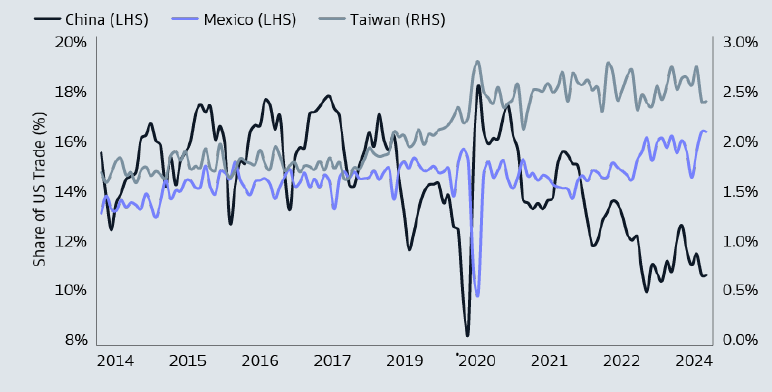

China may be bolstering its gold reserves for good reason. Its share of U.S. trade has reached 5 year lows. Mexico’s share is increasing. Whereas in 2020, China held 18% share of U.S. trade, it now only holds 10%. Surprisingly, Mexico is now a larger trading partner for the U.S at 14% of trade, than China.

Source: Goldman Sachs

We can see the effects of the change in U.S. capital flow manifest itself in the respective stock markets of the two countries:

| Performance | 1 Year | 3 Years | 5 Years |

| MSCI US Index USD | 23.32% | 7.35% | 13.16% |

| MSCI Mexico Index USD | 10.47% | 15.16% | 10.02% |

| MSCI China Index USD | -6.77% | -17.55% | -5.55% |

Performance as at 30 April 2024. Performance in USD and compound annualised. Past performance is not a guarantee of future results. Source: MSCI.

Given the dislocation in relative performance of China’s equity index, some investors may view this as presenting a good buying opportunity. However, major caution is warranted given the history of Chinese authorities intervening in their local equity indices. Whilst Mexico’s equity index and associated earnings growth are somewhat tied to U.S. capital flows, it remains an emerging market, with associated risks.

Please don’t hesitate to contact us if you would like to discuss this information in more detail.