8 July 2024

Dear Fintax Investor

As we have reached the mid-year, we can take stock of the year-to-date performance of various countries and regions and consider the outlook for the remainder of the year.

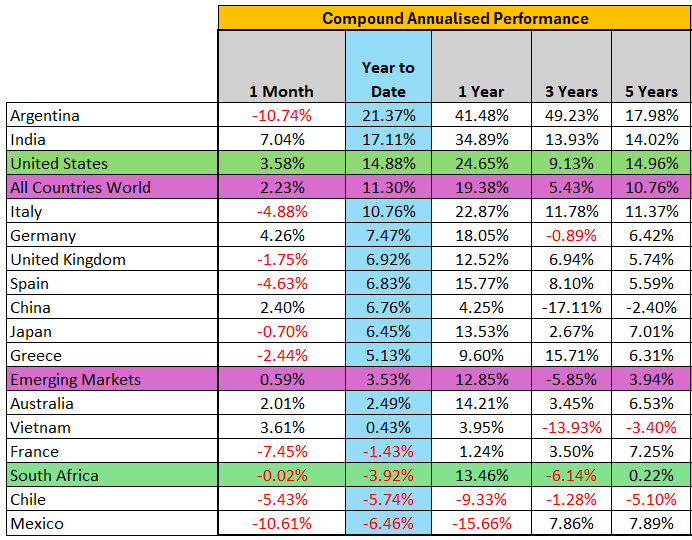

Year-to-date, the best performing stock markets in U.S. Dollars on our country monitor list are Argentina, India, and the U.S. The worst performers on our list are Mexico, Chile, South Africa and France.

Source: MSCI Indices. Performance in USD. Past performance is not a guarantee of future results. Performance to 30 June 2024.

At the start of the year, we highlighted various factors we were considering in positioning client portfolios for the year ahead.

We noted that:

- Approximately half of global democracies will be casting their national vote in 2024.

- Interest rates were high compared to the prior 10 years.

- Inflation was still high compared to the prior 10 years.

- US money market assets were at their highest level ever, benefitting from high interest rates on offer.

Since then;

- India, United Kingdom and South Africa held their general elections. Election results in India and South Africa are being viewed favourably by their respective local and foreign investors. The South African and Indian local stock markets have started to rally in their respective local currencies. However, it’s still too early to determine investor sentiment related to the UK’s general election results.

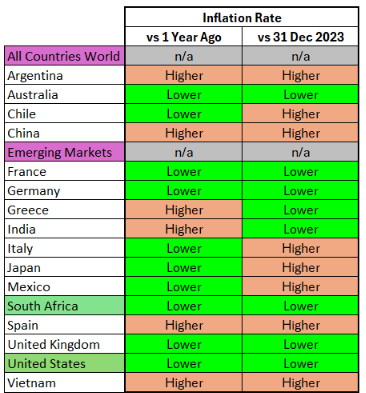

- Albeit sticky, inflation is steadily slowing in many countries we monitor, both compared to 31 December 2023 and the same time one year ago.

Source: Stastics bureau of each country.

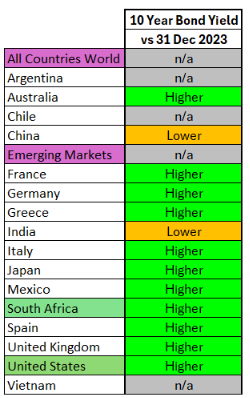

Whilst short-term interest rates have largely remained stable since the start of the year, long-term (10 year) interest rates have risen, except for in China and India. This bodes well for fixed income investors going forward, including Global Balanced and Global Flexible fund investors where the fund managers have a mandate that allows them to invest in these high-yielding instruments;

Current 10 year sovereign bond yield of each respective country relative to 10 year sovereign bond yields on 31 December 2023. Source: Statistics bureau of each country.

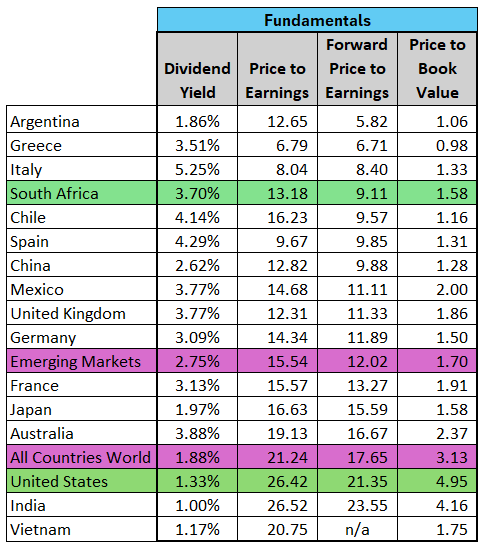

Based on their forward price to earnings ratios, we have ranked the global equity markets on our country watchlist from relative cheapest to most expensive;

Fundamental valuation of countries as at 30 June 2024. Source: MSCI Indices.

Despite Argentina having rallied strongly since the election of Javier Milei, it is still fundamentally ranked as the cheapest equity market on our global watchlist. South Africa ranks fourth on our list in terms of relative cheapness.

U.S. money market assets have continued to rise and now sits at USD6.1 trillion.

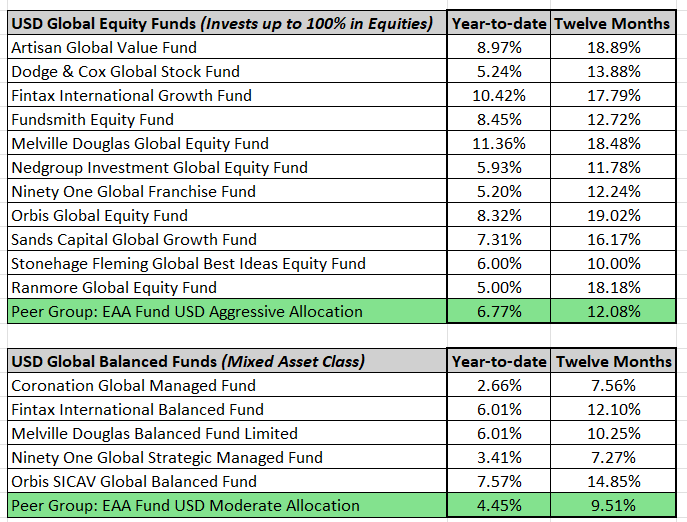

We expect that at least a portion of these yield sensitive assets will be switched to the stock market once interest rates start to be steadily lowered. This bodes well for prospective global equity returns, depending on the valuation of the region and underlying sectors. In terms of the global equity and balanced managers on our global watchlist, the performance year-to-date and over the prior 12 months are as follows:

Source: Morningstar. Performance to 30 June 2024 and is net of each fund’s Total Investment Charge (TIC). Past performance is not a guarantee of future results.

Risks

U.S. Broad Market Index Concentration & Valuation

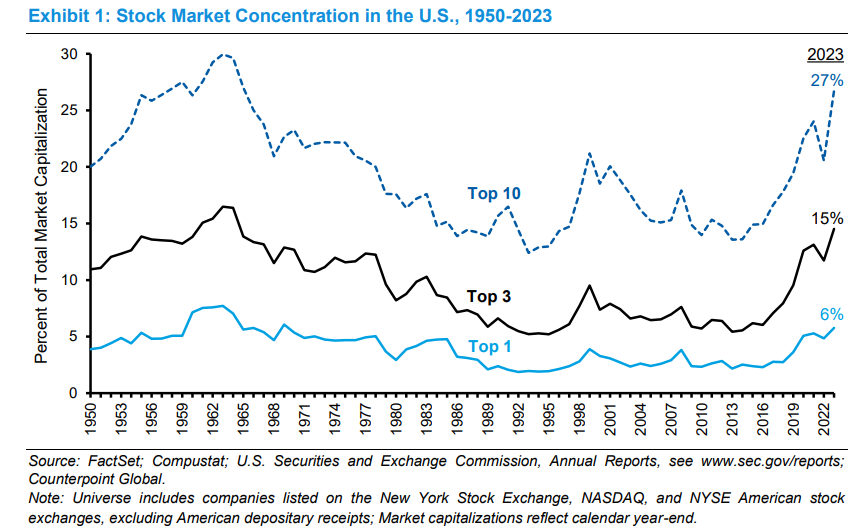

Global equity returns have largely continued to be driven by the so-called Magnificent 7 stocks; Apple, Amazon, Microsoft, Nvidia, Meta (Facebook), Google, and Tesla. This has largely been as a consequence of investor optimism regarding artificial intelligence software applications and related global support hardware requirements. This optimism is not unfounded. U.S. technology sector earnings growth and returns on invested capital have been remarkable. However, the degree of optimism may be overdone as share prices have rallied in excess of actual earnings growth and returns on invested capital. The Maginificent 7’s continued outperformance relative to the rest of the market has resulted in the U.S. stock market (S&P500 Index) now being at its most concentrated level since the early 1960s.

As such, we are of the view that the benefit of the low cost associated with an S&P500 passive index tracking instrument is currently being outweighed by the disadvantage of potentially tracking an overvalued index.

Based on the Shiller Price to Earnings Ratio, the U.S. broad market index is trading at relatively expensive levels compared to its history.

Source: www.multpl.com/shiller-pe

The CAPE ratio is a valuation measure that uses real earnings per share (EPS) over a 10-year period to smooth out fluctuations in corporate profits that occur over different periods of a business cycle. The CAPE ratio, using the acronym for cyclically adjusted price-to-earnings ratio, was popularized by Yale University professor Robert Shiller. It is also known as the Shiller P/E ratio.

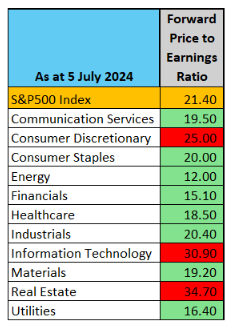

There are, however, opportunities for active managers to take advantage of undervalued companies outside of the top 10 market capitalisation companies in the U.S with many sectors still offering compelling relative value, in particular, energy, financials and utilities;

Source: Yardeni Research. As at 5 July 2024.

In Conclusion

At the start of the year, Goldman Sachs projected five interest rate cuts during 2024. However, a partial pullback from globalisation, and higher energy and labour costs has resulted in stickier inflation, a higher-for-longer interest rate environment and elevated volatility for risk assets. The U.S. Federal Funds Rate (short-term interest rate) is now projected to steadily decline from 5.25% to 2.50% over the next 4 years.

Whilst inflation is showing signs of declining across the global economy, and this signals that systematic, albeit measured interest rate cuts may be nearer on the horizon, investors in mixed-asset investments such as global balanced and flexible funds may be best positioned to take advantage of high yielding longer-dated fixed income instruments while they are on offer.

Investors willing to actively look at global equities will steer clear of the relatively high concentration and valuation on an index level in the U.S. Many global equity and fixed income markets are offering compelling value at current prices.

Please don’t hesitate to contact us if you would like to discuss this information in more detail.