8 January 2025

Dear Fintax Investor

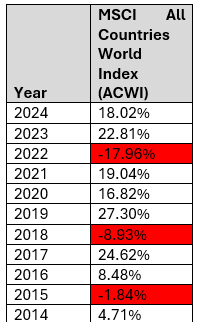

The Past: Performance

2024 delivered another good year for the global stock market. In fact, since the start of 2014, there have been only three negative performing calendar years in USD terms for global equities:

Source: MSCI Indices. Performance in USD. Past performance is not a guarantee of future results. Performance to 31 December 2024.

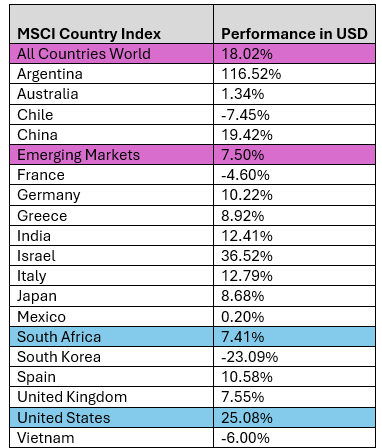

Argentina was the best performing country index for the second calendar year in succession, followed by Israel and the U.S:

Country calendar year performance in USD to 31 December 2024. Source: MSCI Indices

For the first time in five years, South Africa’s stock market delivered high single digit positive performance in USD terms with small market capitalization companies significantly outperforming their larger counterparts.

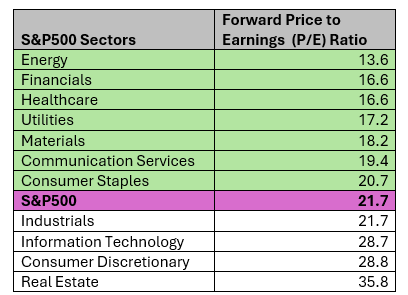

The Present: Valuations

Forward P/E Ratios. Source: MSCI Indices as of 31 December 2024.

South Korea continues to track as one of the cheapest country equity markets along with South Africa. However, these cheap valuations are not without risk. Both countries present political and macroeconomic issues that investors need to remain aware of. The stability of South Africa’s Government of National Unity (GNU) seems to show signs of buckling, along with a particularly high level of national debt that will be difficult to grow out of. While South Korea’s equity market offers compelling value, particularly since 24% of the stock market consists of Samsung, a key beneficiary of the rise of artificial intelligence use, their political situation remains uncertain, as their president was impeached by their National Assembly last month.

Whilst the U.S. looks expensive on an index level, there remains opportunities in various sectors of the broader U.S. market, in particular energy, financials and healthcare:

Source: SS&P500 Sectoral P/E Ratios. Source: Yardeni Research as of 6 January 2025.

The Future: Expectations

On a global scale, Morningstar expects attractive returns from emerging markets over the next 10 years. The equity markets of Brazil, China and Korea all expected to deliver double-digit returns in USD:

Interest Rates – What’s the Story?

With the inflation rate moving steadily downwards, and interest rates consequently being cut, the yields on cash and other short-dated instruments are becoming less attractive. Morningstar forecast U.S. interest rates to decline to 2.00-2.25% by the end of 2026 from the current level of 4.25%-4.50%.

Morningstar’s forecast is in contrast to the latest future market implied rate, signaling that U.S. interest rates will only reduce to 3.5% by the end of 2026.

While the current long-term spreads above the short end of the yield curve are not particularly attractive, investors may want to start transitioning into longer-dated instruments based on Morningstar’s interest rate forecast of lower-than-expected interest rates by the end of 2026. If their forecast plays out, Morningstar projects an unusually high return from longer-term bonds relative to cash deposits over the next 10 years. Longer-term bonds offer price appreciation in a declining interest rate environment whereas cash only offers reduced interest payments.

Within fixed income, investment manager T. Rowe Price views emerging market corporate bonds as being particularly well positioned, given their higher yields and improving credit quality. Developing economies are also growing, partly because their central banks are ahead of the U.S. in their interest rate cutting cycle.

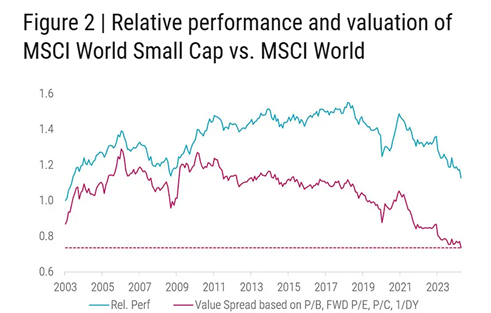

Small Caps – Digging Deeper

Small market capitalization (small cap) stocks have underperformed their larger counterparts since 2011. Typically, during periods of small cap underperformance, active managers tend to underperform their passive counterparts. On a broad level this has been the case. However, research by Robeco shows that small caps are currently offering a multi-decade opportunity for investors, trading at a 20% discount compared to their large cap counterparts. This is their cheapest level since 2003. Active managers that can invest in these companies should be able to extract outsized returns relative to broad index trackers. Goldman Sachs expect small cap financials and healthcare to benefit most from the rerating.

Source: Robeco: The Investment Engineers.

The Snowball Effect – Growth in Artificial Intelligence Use

The pace of artificial intelligence (AI) development has continued to accelerate. Below is Morningstar’s estimate for AI chip sales growth over the next 5 years, which is expected to more than double from the current base. Nvidia will likely continue to be the main beneficiary of sales growth given their lead in the development of AI focused chips:

Source: Morningstar Research.

Unlike the dot-com bubble, the stock prices of AI companies have been driven by actual earnings. For example, in March 2000, Cisco had a forward Price to Earnings (P/E) ratio of 130x. By contrast Nvidia has a P/E ratio of 33x, a ratio more typical of a fast-growing company.

Whilst many of the primary chip designers and manufacturers are clear beneficiaries of the rapid pace of AI development, their valuations are not as attractive as they were two years ago. Only Microsoft and Alphabet are still offering decent value at price discounts of 15% and 20%, respectively, relative to their estimated respective fair values:

Source: Morningstar Research.

There are, however, many ancillary companies and industries outside of the AI chip designers and manufacturers that will likely benefit from the more widespread use of artificial intelligence. For example, companies operational in logistics, healthcare, energy generation, data center providers and general retail sectors.

A noteworthy example is traditional retailer Walmart. The company is developing artificial intelligence driven hyper-curated choices for their customers as they multi-task while shopping (for example shopping while watching TV, driving or browsing social media and receiving hyper-specific shopping recommendations and automated orders based on the time of day, week or month).

Opportunities

- Emerging market corporate bonds are offering attractive yields compared to the developed world which is heading for a lower yielding environment

- There are many sectors outside of information technology still offering compelling value that will benefit from the rise of AI

- Healthcare companies seem to be particularly well positioned for growing AI use and they are trading at attractive valuations on a sectoral level

- Financial companies tend to profit from a more normal yield curve as short-term interest rates further reduce

- Smaller U.S. companies are likely to benefit from higher tariffs placed on imported goods to the U.S. An allocation to active managers that can invest in these companies warrants careful consideration

- Index-trackers that invest in broadly undervalued sectors of the market (in particular, financials and healthcare) is a cost-efficient way to access the opportunities those sectors present

Risks

- U.S. dollar strength. The U.S. dollar has strengthened against all major currencies for the prior 13 years. The U.S. dollar may remain strong for the foreseeable future, or it may revert to its long-term fundamental valuation. International exposure is one way to mitigate a U.S. dollar reversion to its fair value

- Incorrect positioning for a lower-than-expected interest rate environment. There is an estimated USD6.51 trillion held in money market (cash) assets as of October 2024. Some of this will transition to higher yielding assets in the stock and bond markets if interest rates continue their decline, helping to drive up asset prices of riskier assets

- U.S. government debt is 120% of its Gross Domestic Product (GDP) – the same level it was during World War II. U.S interest payments on national debt is now higher than its military spending, an historic indicator of empire collapse. Unexpected structurally high inflation will negatively impact governments with high debt levels. International diversification is therefore key

- A portfolio overweight to index-trackers (passive instruments) that track overvalued indices and sectors (U.S. real estate, U.S. consumer discretionary) may result in permanent capital loss

- Geopolitical risks. For example, the expansion of regional wars, reshoring of supply chains leading to higher overall prices, and higher tit for tat tariffs during the upcoming Trump administration may lead to more sticky inflation levels

- A slowdown of the global economy in the first half of 2025 if weaker data from China weighs on the rest of the world. An unexpected recession in key markets may lead to the prices of longer-dated less creditworthy bond instruments declining sharply, and fully valued equity markets selling off

In Conclusion

A significant portion of our client assets are strategically positioned in sectors that complement, yet are distinct from, the more widely recognized artificial intelligence (AI) chip companies, offering compelling value. As we enter the next phase of the interest rate cycle, it’s crucial to carefully navigate market conditions, especially as capital flows gravitate towards higher-yielding asset classes amid a likely decline in interest rates. However, we must remain mindful of the potential for persistently high inflation. Given this, a gradual transition to higher-yielding assets—rather than a swift shift—appears prudent to mitigate risk and optimise returns.

8 January 2025