Dear Fintax Investor

Last month the Balanced Fund returned 2.7% and the Growth Fund 3.5%. Over rolling 12 months the Funds have now returned 2.3% and 1.8%, respectively, relative to 5.8% for the MSCI All Countries World Index (ACWI) and 1.1% for the ICE BofAML Global Broad Market Bond Index.

Beyond Meat – Beyond Returns?

Earlier this month Beyond Meat Inc listed on the NASDAQ stock exchange, in what is termed an Initial Public Offering (IPO). Beyond Meat produces plant-based meat substitutes which are supposedly set to replace the traditional burger patty consumers are currently eating at the big fast food chains like McDonald’s, Burger King and Wendy’s. Some consumers are saying that the taste of the Beyond Meat plant-based burger patty is near indistinguishable from that of the traditional animal protein-based version.

What these consumers don’t know (or choose not to know) is that the plant-based patty is full of derivative ingredients which lose a lot of their nutrients during processing (additionally, it contains 5x as much sodium as an unseasoned beef patty as well as methylcellulose – a laxative). With Beyond Meat delivering full-year revenue of just $87.9 million and a full year net loss of $29.9 million (and a high stock market value of $5.5 billion), time will tell whether the consumer bites as much as speculators have.

What is more interesting than the contents of the plant-based product, from an investor’s perspective, is that Beyond Meat’s IPO was 30x oversubscribed despite the company making significant financial losses, and its marketed main shareholder – Tyson Foods, announcing that it sold its stake in the company.

How well do IPOs typically fare?

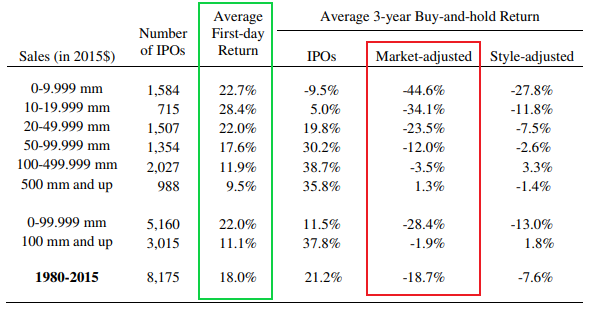

Below is a table showing how various size companies (according to sales) have performed on the first day of their IPO, and then the immediate three years after their IPO relative to the performance of the general U.S stock market:

Clearly, the first day of an IPO tends to work out for most companies (small to large). Thereafter, longer-term returns tend to lag the market, on average. Not surprisingly, investment bankers (and often major shareholders) tend to make their return on the first day of listing when selling to less-informed investors. Unassuming investors often choose to buy the story being sold to them on the first day, instead of the true underlying cash flow generating prospects of the company. The data shows, that over the long-term, following a strategy of buying the story instead of the company’s fundamentals, tends to have a bad ending.

The best places to find favourable mispricing opportunities are typically not IPOs but rather company spin-offs, divestitures, asset sales, forced selling by index funds, forced selling by institutions, or some other catalyst (a special situation). Often, it is where there is a lack of interest (and lack of information) where favourable mispricing opportunities tend to develop. However, these tend to make for boring stories.

The FP Crux Special European Situations Fund, held in the Fintax Funds, has a clearly-defined investment mandate to find these type of special situations. The Fund has delivered 7% annualized in US$ terms since the position was initiated in early 2011 and, has therefore, meaningfully added to the longer-term returns of the Funds.

One of the holdings that fits the bill of being a special situation is Scout 24 – a German online classifieds business, specializing in property listings. FP Crux recently disposed of the business upon the announcement that the Scout 24 Board backed a EUR5.7bn takeover bid from two private equity companies. Their all-cash offer represented a 27% premium to the prevailing stock price before the offer was announced.

When FP Crux invested, there was significant regulatory uncertainty as to how the German government would implement new regulations to lower the fees associated with buying a property. It was feared that the new regulations would cut out estate agents who in turn supplied the bulk of the company’s advertising revenues. FP Crux took advantage of the uncertainty by initiating a stake in the company when investor interest was low. The thesis was that if proposed regulation was implemented, ad revenues from private sellers would help make up the shortfall from estate agents. It turned out to be an attractive investment.

As always, we welcome any comments, queries, or questions you may have.

I gotta favorite this site it seems very helpful very helpful