Global equity markets delivered their strongest monthly performance thus far in 2024 after a disappointing April. However, most of recent global equity index rises can be attributed to a few key companies. Nvidia’s share price has now more than doubled in 2024 and Apple, Microsoft and Nvidia are responsible for one-fifth of May’s global equity performance. The S&P500 index is now at its highest concentration levels in 60 years. Microsoft, Apple, Nvidia and Alphabet now make up 23.6% of the S&P500 index. To provide a sense of how concentrated the S&P500 index now is, an investor must go all the way back to 1964, where four companies reached a similar level of index concentration (back then it was IBM, Exxon, General Motors & AT&T at 24.6% of the S&P500 index). It is therefore important to invest in managers that can invest in companies and weightings different to the index should any of these four companies deliver earnings lower than what the market anticipates.

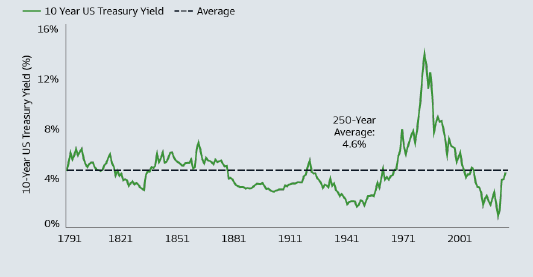

US 10 Year Treasury Yield – a 250-year history. Source: Goldman Sachs, St. Louis Federal Reserve.

The current market landscape, characterised by stickier inflation, higher rates, and increased equity concentration, has become the new “normal”. Although the higher-for longer rate environment is unique relative to recent years, the spike in the 10-Year US Treasury has pushed the yield in line with the 250-year average of 4.6%. No wonder U.S. money market assets now sits at $6.1 trillion. As structural uncertainties play out, remaining balanced across asset classes and investment styles as dynamics inevitably shift makes sense.

Please don’t hesitate to contact us if you would like to discuss this information in more detail.