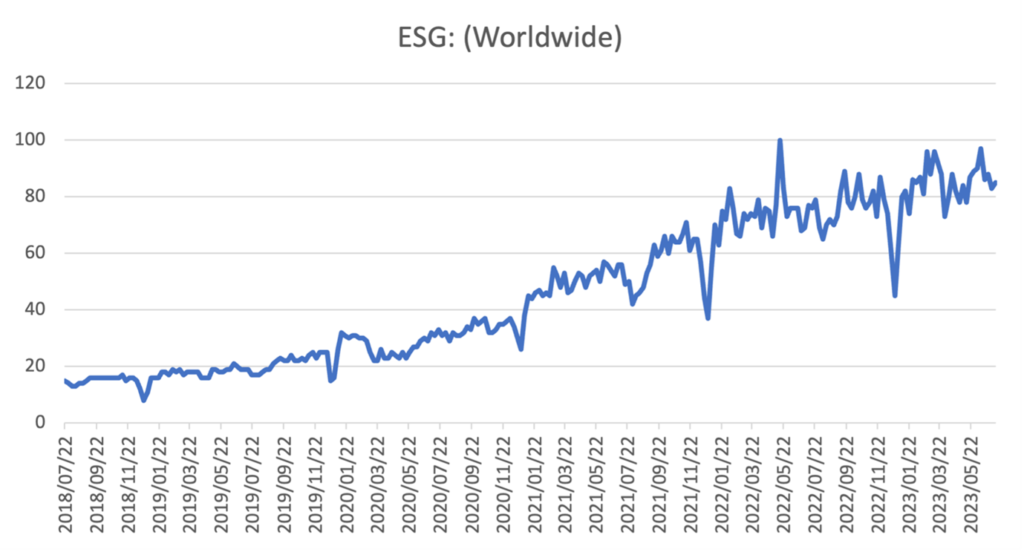

ESG (Environmental, Social, Governance) has become the most used acronym in the investing world. Google Trends shows that interest in the term has continued trending up over the past five years. In fact, it is rare for a listed company or investment manager not to reference the words “Sustainable Investing” at least once in their presentation. Markets are driven by capital flows and having your company classified as scoring high on a sustainability index means that you will likely attract more capital from both passive and active investment managers, helping to drive your company’s share price up. Investment managers are launching unit trusts that focus solely on investing in companies that rank high on sustainable investing indices.

There are major flaws in how these indices are constructed. Tesla for example does not feature high on sustainability indices but tire manufacturers like Pirelli & Co. S.p.A. as well as Hankook Tire & Technology Company do. In fact, these two tire manufacturers are classified by S&P in their ‘’Global Gold Class’’ ranking, which is the highest S&P Global ESG score that can be assigned to a listed company. You can read more about the negative environmental effects of used tires here: https://www.nationalgeographic.com/environment/article/tires-unseen-plastic-polluter. Coincidently, no one talks about the statistic that up to 55% of roadside traffic pollution is made of non-exhaust particles, like tires (20% of that air pollution comes from brake dust) Source: https://uk-air.defra.gov.uk/assets/documents/reports/cat09/1907101151_20190709_Non_Exhaust_Emissions_typeset_Final.pdf

Many of these sustainability indices are constructed using “negative screening’’. Simply this means that companies which are viewed as unethical or detractors from society are excluded. Examples include weapons and munition manufacturers like Raytheon, casino operators like Wynn and fossil fuel and gas companies like BP or Shell. Not investing in Shell due to it being ranked low on a sustainability index makes no sense. In fact, the going concern of companies like BP and Shell are critical to help transition the world’s primary energy usage towards renewable sources.

Not only do these companies provide the petrochemical-derived resins which go into the manufacturing of wind turbine blades they also produce the lubricants and hydraulic fluids used in the maintenance and operation of wind turbines and other renewable energy systems. Their material use in medical applications is also quite common, including syringes and petroleum jelly.

Noteworthy is that many companies who use rechargeable batteries in their products like cellphones rank high on these indices. Cobalt is typically a key ingredient in the manufacture of these batteries. Click here for more information on how cobalt is mined: https://www.youtube.com/watch?v=CIWvk3gJ_7E. Suffice to say mining cobalt can be an extremely polluting, dangerous and dehumanizing venture.

The idea is therefore to avoid investing in companies that rank low on sustainability indices, no matter how illogical their construction is. By withdrawing capital from low-ranked companies and driving capital towards higher ranked companies the premise is that this will encourage corporates to steer clear of non-high ranking ESG capital expenditures and by implication drive the world away from polluting ventures and towards a cleaner, sustainable future. Cue the bell for Pavlov’s dog and the accompanying incentive.

The ”ESG” search term uptrend has also caught the eye of many fund managers who are now providing unit trusts that invest in these indices. A quick search on the Trustnet website for funds featuring the word “sustainable’’ in their name yields 713 funds. “Worldwide Sustainable’’, “Sustainable Equities”, “Sustainable Climate Solutions” “Sustainable Global Thematic Credit”, “Sustainable and Responsible Investment” are all common names. Many of these are pure passive index trackers.

One would think that an active manager seeking out the best investments would invest in companies that will likely exist in 20-30 years, i.e. be operationally sustainable and profitable on a long-term basis, no matter how high or low they may feature on a poorly constructed index.

Fund managers are responsible for investing investor capital to their best view. By restricting the capital being allocated to companies that rank high on deeply flawed indices one would think that they are locking in a significant opportunity cost for their investors. Of course, sustainability is important and of course the environment is important. It also goes without explaining that companies should be held accountable when they pollute and destroy the environment and make use of child labour. However, sustainable investing box ticking exercises that go into the construction of made-up indices is not the way forward. Common sense should prevail.

Not surprisingly, whilst many of these fund managers tout the benefits of the global ESG drive, and expect investors to carry the cost, they themselves are not investing a cent of their fees into the same global ESG cause they are marketing. So too for the custodians of the assets, the advisors, the stockbrokers and the administration platforms. Clearly there is a misalignment of interests in this ESG hype value chain.

If a global cleaner, sustainable, humane environment is what is sought then all parties in the value chain must play their part, not just the end investor. We propose that the industry moves towards investing actively in good, sustainable businesses, not just through a box ticking exercise but through active allocation and take individual as well as collective responsibility. Everyone along the investment value chain should have skin in this game. Don’t be in a position where the saying holds: ‘’do as I say but not as I do’’.

In our search for a fund manager that provides the closest thing to ‘’walking the talk’’ as a sustainable active manager, we came across PortfolioMetrix and their PMX Sustainable World Fund. The key features that differentiate it from sustainable themed index trackers are:

- The fund only invests in active managers

- The focus is on positive screening i.e. identifying companies that are truly driving sustainability

- On-going engagement with underlying investee companies to drive sustainable practices

- Investing an allocation in active managers that also focus on impact investing. This is a form of investing that commits funds to projects or companies that align with specific social or environmental causes such as clean energy, sustainable agriculture, affordable housing or healthcare

- Some of the underlying managers also contribute 10% of their revenue that support causes such as Tribal Survival and City Harvest

27 July 2023