Whilst investors in equity markets experienced large declines in 2018, thus far in 2019, returns to both equity and fixed income investors have been more favourable. Returns have, for the most part, been driven by the U.S Equity market (S&P500), and within that market, by the so-called FANG stocks (Facebook, Amazon, Netflix, Google / Alphabet).

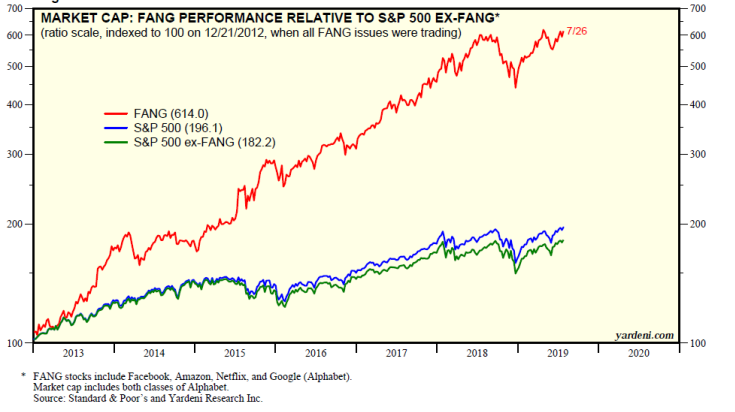

Below is a chart showing how well these four high tech stocks have performed (in red) relative to the S&P500 Index, with the FANG stocks (in blue) and without the FANG stocks (in green):

The rate of market price growth that these four high tech stocks have delivered relative to the rest of the U.S equity market, has been incredible. In 2013 they made up 3% of the entire market capitalisation of the S&P500. They now make up 10%. When two other high growth tech companies like Apple and Microsoft are included, the share of the S&P500 of the FANG+MA stocks gets pushed up to 16%. Whilst this concentration is nowhere near the concentration of the local market i.e Naspers in the Johannesburg All Share Index (ALSI), it is still considerable, and holds meaningful risk to passive investors (like ETF investors) or index hugging investors, when a downturn in their market valuation occurs. Why? Because some of these companies are trading at extremely expensive levels, making the likelihood for a downturn in the future earnings outlook and consequently a decline in their share prices more likely. Buying a great asset for $10 that is worth only $2 has historically been a poor investment strategy.

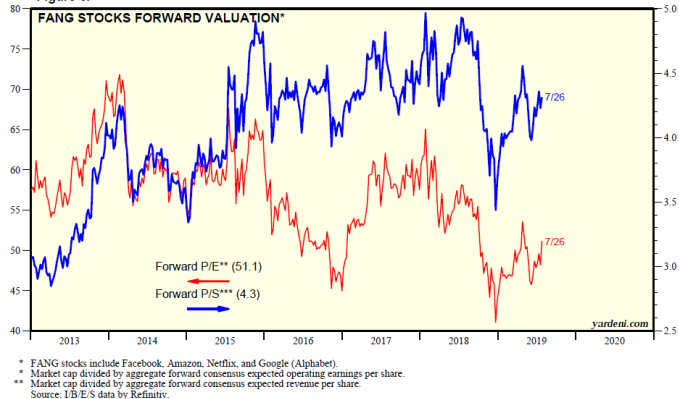

Consider the second chart below. It shows the aggregate valuation of the FANG stocks. The forward Price to Earnings (P/E) ratio (in red) of the FANG stocks is 51.1x. Importantly, the denominator in the ratio (Earnings) is not depressed due to a cyclical downturn or poor economic conditions, which would result in an artificially inflated ratio. In fact, these companies are banking record earnings, and market prices suggest investors think record earnings will likely continue to be delivered for a very long time. In essence, on top of record earnings, investors are willing to pay 51x for that earnings. Compare the 51x to the long-term average P/E ratio for the S&P500 of 17x, and it becomes clear that investors are factoring in significant growth for these companies relative to the market. It means that investors are willing to wait 51 years to get their investment back should these companies not be able to grow into the price investors are willing to pay. That’s a big bet on the future growth prospects of these companies, and doesn’t really factor in any possibility of future disruption or disappointment, which is part and parcel of doing business in the high tech sector.

If you think equity market investors have lost their minds for willingly waiting 51 years to get their investment back, fixed income investors are willing to wait up to 20 years to get less than their money back. In essence, they are willing to make a loan, receive no interest, and get less than their loan value back at the end of 20 years. Currently, up to $14 trillion of investors’ capital are willing to make this investment globally. The receivers of this capital, primarily governments in Europe, are more than happy with the cheap funding and they’ll keep on issuing negative yielding bonds for investors to purchase as long as investors are willing to invest in them. While European governments can probably put this capital to good use, it potentially doesn’t bode well for the future returns of the investors in those negative yielding instruments.

Market prices suggest that investors in the FANG+MA are extremely positive about the future growth prospects of these companies. However, fixed income investors are signalling that they are not as positive about future market conditions. In effect, given their risk assessment about the future, fixed income investors are willing to earn no return over a period of up to 20 years (and lock-in a calculated loss now). Who is right and who is wrong? Time will tell.

As always, we welcome any questions, comments or queries you may have.