Inflation definition: a general increase in prices and fall in the purchasing value of money.

Rising inflation is currently taking place in the U.S. Interest rates have not yet risen to keep it in check. The U.S Federal Reserve has noted that they expect rising inflation to be ‘’transitory’’/temporary. Below is a graph showing the US inflation rate (purple) compared to the 10 year US treasury interest rate (orange). In line with the Fed’s transitory view, they have not yet used higher interest rates as a tool to keep a lid on inflation:

Let’s take a look at some of the contributors that may lead to non-‘’transitory’’ rising inflation:

Input Costs

Commodities & Shipping Rates

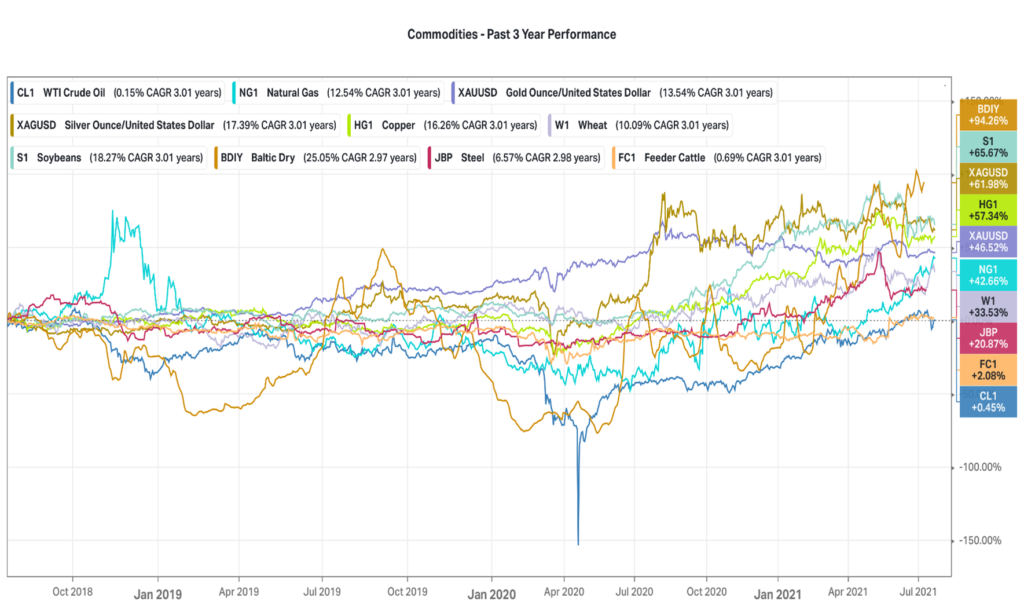

One of the significant contributors to higher inflation is rising input costs. Fuel / transport and materials are two significant input costs. Below we have included the prices of various commodities over the past three year period. Noteworthy, is that the crude oil price (dark blue) has only now reached the price level it was three years ago and is therefore currently not a particularly significant contributor to unexpected rising inflation over the shorter term.

However, shipping costs, which have risen by 94% over the past three years as shown by the orange line at the top of the graph could signal unexpected higher inflation. The copper price (yellow), used as a barometer of economic activity, particularly global construction and its associated costs, has also risen by 57% over this timeframe.

Below we show a more official graph provided by the St. Louis Fed. It shows the U.S Producer Price Index by Commodity. Clearly, input costs in aggregate have recently risen sharply, contributing to more expensive goods and services.

Consumer Spending

We’ve discussed the supply side of inflation (called cost push inflation). On the demand side (called demand pull inflation), the U.S has pumped significant money supply into the market through its various stimulus programs. Below we show the savings rates of US citizens over time. Noteworthy is that despite the recent significant increase in the money supply, savings rates are starting to decline sharply. This implies that consumers are starting to spend what they have received from the US government through its stimulus programs. More money being spent is supportive of higher inflation:

What is the current State of Inflation?

There are signs that inflation may not be as transitory as the US Fed makes it out to be. Recently, US Fed Chairman Jerome Powell admitted: “I think we’re experiencing a big uptick in inflation. Bigger than many expected. Bigger than certainly, I expected.” If the Fed decides to use higher interest rates as a tool to help keep inflation in check, it would be bad for employment. The longer the Fed tolerates inflation to keep employment high, the less chance there is of inflation being transitory.

For more information on the impact of rising inflation on asset valuations please refer to our article: Destination Inflation as published on our website.

Fintax has been an authorised financial services provider (FSP642) since 1983 and is suitably regulated by the FSCA.