Source: Fintax Research

Investors will recall that the Fintax Funds follow a blended investment style strategy with holdings in Value, Quality and Growth.

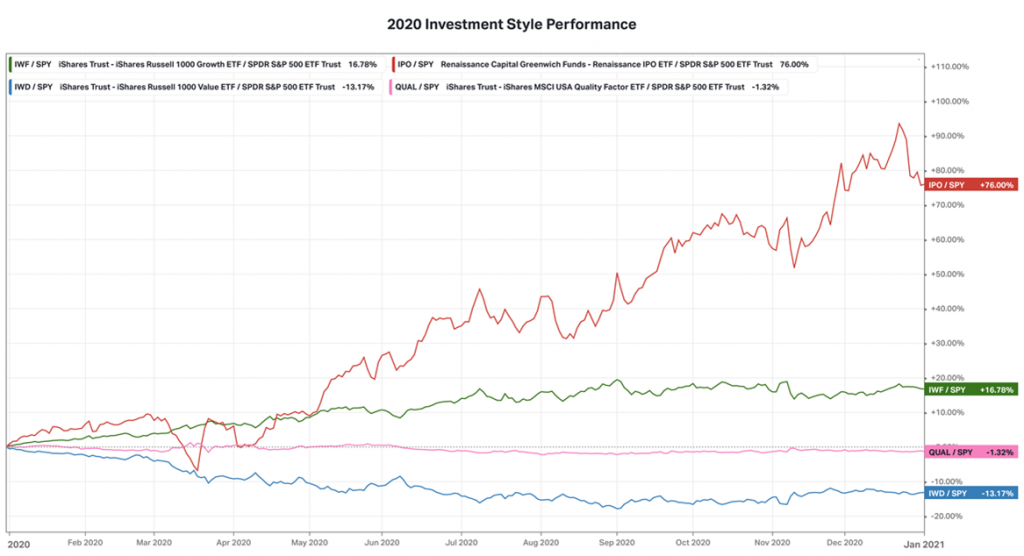

One of the most interesting aspects in 2020 was the performance of Initial Public Offerings (IPO). The IPO sub-style was the best performing investment style out of the list of investment styles we monitor. These are private companies that become publicly traded companies by listing on the various global stock exchanges. In the graph below, IPOs are depicted by the red line. This style delivered +76% for the 2020 calendar year. The Fintax Funds have exposure to IPOs through the Merian Chrysalis Fund which delivered 57% for the full year. Investors will also note the significant underperformance of the Value style, depicted by the Blue line below. Growth is depicted by Green and Quality by Pink.

What was the driver behind this remarkable performance of IPOs? Simply put, free money. During the 2007/2008 global financial crisis, central banks quickly learned that they can limit the extent and duration of a financial crisis by reacting quickly and pushing massive amounts of cheap money into the market. They do this through lowering interest rates and purchasing financial instruments. During the March 2020 coronavirus crisis, markets plummeted and central banks reacted by flooding the market with free money. In this case, they also sent free cash cheques to the US public.

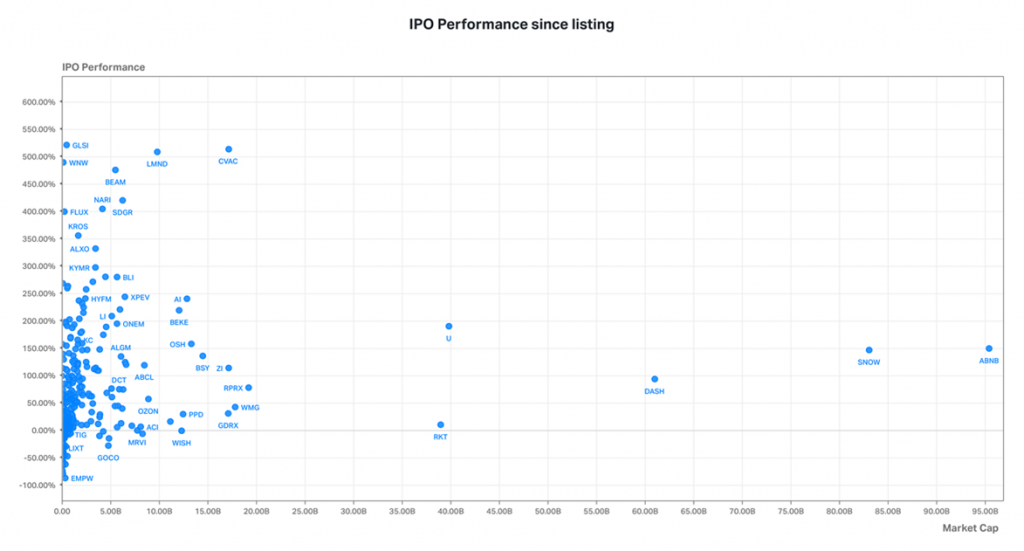

To give investors a better idea of where this latest round of free money is flowing, take a look at the graph below.

The graph shows IPO performance versus market capitalisation. Each dot represents an IPO company’s performance since listing on a stock exchange relative to the size of its market capitalisation. The higher up the dot on the graph, the better the performance of the listing, the further right, the larger the market capitalisation of the listed company.

Out of 383 IPO companies that listed in the US in 2020, only 59 of them have delivered negative price performance since listing. This is despite only 63 of them being cash flow positive. Paying up for current and future negative cash flow, typically signifies that the market is acting irrationally. Clearly, investors don’t care about getting their money back.

Furthermore, out of the 383 companies that were IPOs, 157 of them are classified by industry as operating in Capital Markets. This is interesting because this signifies that many of these IPOs are classified as SPACs (Special Purpose Acquisition Companies). What is a SPAC? A SPAC is a corporate shell that lists on the stock market with the intention of buying other companies. Investors are, therefore, willing to invest in a SPAC with no earnings (negative earnings because of the SPAC manager fee) with the promise to buy other companies, most likely overvalued companies. This is a clear example that the market is currently showing little regard for the risk of permanently losing money.

No wonder that in a recent letter to investors, iconic investor Jeremy Grantham from GMO warned:

‘’The long, long bull market since 2009 has finally matured into a fully-fledged epic bubble. Featuring extreme overvaluation, explosive price increases, frenzied issuance, and hysterically speculative investor behavior, I believe this event will be recorded as one of the great bubbles of financial history, right along with the South Sea bubble, 1929, and 2000.’’

It is, therefore, as important as ever to maintain a diversified portfolio of investment styles and asset classes in order to weather the burst of those sectors that are in a bubble.

Fintax has been an authorised financial services provider (FSP642) since 1983 and is suitably regulated by the FSCA.