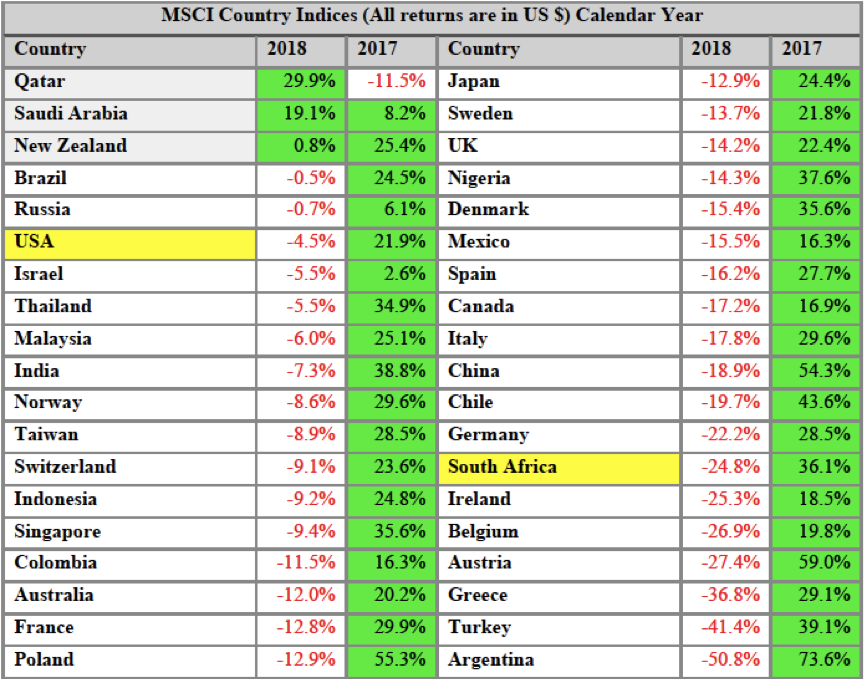

In December 2018, global equity markets suffered their worst monthly performance since the 2008 Global Financial Crisis (GFC), thereby dragging down the year’s returns. There were not a lot of places to hide with Qatar, Saudi Arabia and New Zealand being the only positive performance in USD in the 2018 calendar year. South Africa was one of the worst performers in 2018 (down 24.8%). While viewing 2018 in isolation makes for hard reading, the broad equity market was bound to give back some of its returns given the strong performance it delivered in 2018, as the above table illustrates.

Given the sharp, sudden sell-off during the latter part of 2018 it was worthwhile noting that it was not driven by poor corporate earnings numbers. In fact, on aggregate the S&P500 registered its fifth consecutive quarter of earnings growth. Whilst the reasons for the sell-off are up for debate, we do know that at the start of 2019 global markets on aggregate are now cheaper relative to where they were at the start of 2018, with global earnings-and dividend yields being particularly attractive, boding well for future returns, as the below table helps to illustrate:

| As at 31 December 2018 | Dividend Yield | Forward Earnings Yield |

| MSCI World | 2.76% | 7.43% |

| MSCI Emerging Markets | 2.91% | 9.52% |

| MSCI All Countries World Index (ACWI) | 2.78% | 7.68% |

Given these attractive yields, the London advisory team are planning to increase their exposure to attractively priced equities in the coming months. It seems investors are broadly in agreement and have, since year-end, started to reverse the global market sell-off with the MSCI World Index rising by 3.9% and the S&P500 by 10.5% in USD. Attached you will find the London advisory team’s preliminary feedback on the performance and positioning of the funds to end 2018 and their outlook for 2019. Their quarterly commentary, which will provide a detailed breakdown of performance, is currently being prepared and will be sent in the next couple of weeks.

As always, we welcome any comments, questions or queries you may have.