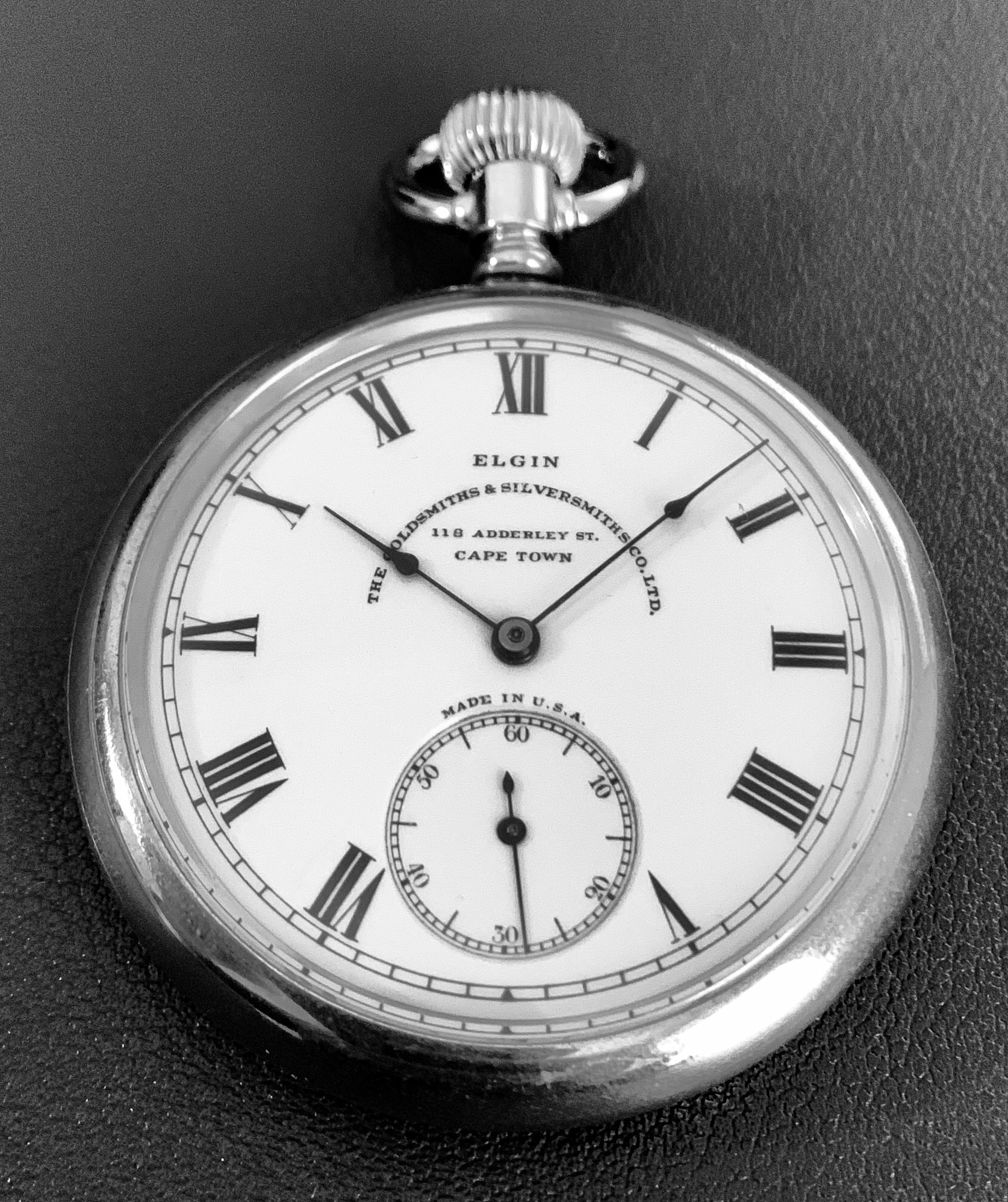

Collecting can be an addiction. I have it. Mine is vintage watch collecting. My collection of vintage pocket watches stretches all the way back to the mid-1800s. The watches themselves are beautiful, and a challenge to repair and service. But, the stories, this is where the addiction starts. The Goldsmiths & Silversmiths Co. Ltd. was established in 1880 and was located at 112 Regent Street, London. Back then, they also had a branch in South Africa, located at 118 Adderley Street, Cape Town. I own two pocket watches that have dials inscribed with their Cape Town branch details, an Elgin, and a Waltham (photo below).

Source: Author. 7-jewel Elgin pocket watch.

Over time, the Goldsmiths & Silversmiths Co. Ltd. amalgamated with various companies that finally merged into Garrard & Co. They were the crown jeweller, a title that carries significant historical and cultural importance. In 2007, it was announced that Garrard & Co.’s services as crown jeweller were no longer required – ending 166 years of Garrard’s tenure. Today, 118 Adderley Street, Cape Town is still a beautiful building in the inner city that is named Constitution House and offers office space.

The point of this story is that there is a phenomenon called survivorship bias. There are many excellent jewellers like Garrard & Co., that don’t manage to stay in business. The ones that do, the survivors, can continue to draw on their heritage and experience to deliver exceptional jewellery. The number of jewellers in existence over the prior 200 years is immense. The number of survivors, those still in business, are not.

The same goes for unit trust funds, of which long-standing ones can close and where new ones are created daily. We often see unit trust funds delivering excellent 5 year performance, only to make a key investment mistake and underperform for the next 5 years. When we look at long-term performance, it only includes the performance of the survivors, and excludes the non-survivors, those that made fatal investment mistakes. Those that remain in business, can continue to draw on their history and experience.

The Fintax Intl. Funds have an official inception date of 2004, but a history going back to 1998. They have gone through various market cycles, and crises, and have survived. The funds have significantly contributed to both the discretionary and pension fund capital of our investors. Remarkably, many of our long-standing clients have been invested since their inception. In 2023 Morningstar took over the effective investment management of the funds. Both funds continue to outperform their respective peer groups by meaningful margins.

Please don’t hesitate to contact us if you would like to discuss this information in more detail.