18 February 2025

Dear Fintax Investor

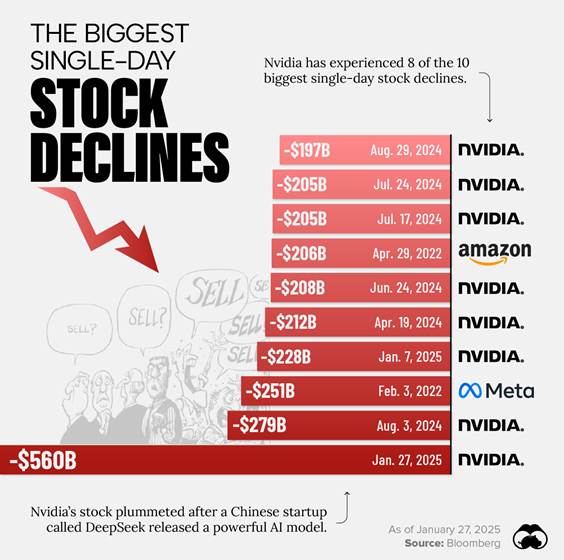

Late in January, Chinese startup DeepSeek unveiled a cost-effective artificial intelligence (AI) model that requires significantly fewer AI chips for training, yet yields surprisingly strong results. This announcement led the market to revise its expectations for AI chip demand, driving down share prices of chip manufacturers, with Nvidia, the largest in the sector, experiencing a 17% share price decline in one day. Given its size, this resulted in the largest single-day stock decline in history, USD560 billion of market value wiped out. Investors in Nvidia have now experienced 8 of the 10 biggest single-day stock declines in history.

However, post decline, the market soon recognized that companies with substantial AI chip infrastructure investments could still leverage this new technology to enhance their own models, maximizing the value of their existing assets and boding well for future infrastructure investments. Share prices of AI chip manufacturers are rapidly recovering.

This phenomenon aligns with Jevons Paradox: as technological progress increases efficiency and reduces the cost of a resource, demand tends to rise rather than fall, ultimately increasing overall resource consumption.

Goldman Sachs views DeepSeek’s release as signalling a new phase in the AI lifecycle—transitioning from infrastructure development to revenue enablement, and eventually to productivity gains. This shift benefits companies that may not directly develop AI infrastructure but can capitalise on AI to create new revenue streams, leading to broader productivity improvements. For investment managers focused on high-quality holdings, such as those in the Fintax funds, this development is a positive indicator for companies poised to integrate AI effectively and drive long-term growth.