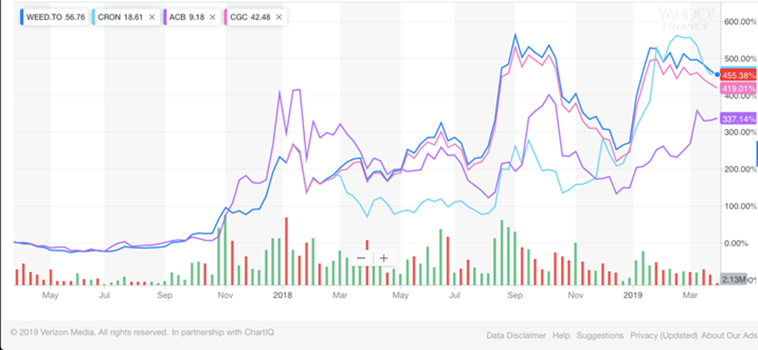

Over the past two years, various cannabis focussed companies have delivered between 337% and 455% for their investors. Tripling and quadrupling your money in two years is nothing to be coughed at.

In late 2018 Canada become the first major country to formally legalize the cultivation, possession, acquisition and consumption of cannabis and its by-products. This followed a slew of cannabis focussed companies listing on the Canadian stock exchange offering investors an entry into the fast growing cannabis market.

It is remarkable how attitudes have changed from people being caught with the plant receiving extreme prison sentences to at least 21 countries having legalized cannabis either fully or partially for medicinal use.

It is important to make the distinction between marijuana, hemp and cannabis. Cannabis is a family of plants with hemp and marijuana both being derived from the Cannabis Sativa sub-family. Marijuana is largely grown for recreational and medicinal purposes (being abundant in both Tetrahydrocannabinol or THC, which has psychoactive properties and Cannabidiol or CBD, which has medicinal properties), whereas hemp is primarily grown for industrial purposes (being low in THC). The two plants also look slightly different.

The original prohibition of the entire family of cannabis plants was driven by powerful interests including Harry Anslinger (America’s drug czar), William Randolph Hearst (the powerful media mogul), John D. Rockefeller (at that time the richest man in the world) and the DuPont company (developer of nylon, teflon, kevlar and lycra, amongst others).

These powerful interests were against the legalization of cannabis for various self-serving reasons:

- Anslinger campaigned for the prohibition of cannabis due to the prohibition on alcohol having been lifted and the Federal Bureau of Narcotics (which he headed) otherwise being largely irrelevant.

- Hearst owned forests to produce paper for his media empire. Fibre from hemp is not only better than timber for producing paper, but takes only 6 months to grow.

- Rockefeller viewed hemp-sourced ethanol as competition to his oil business (after all Henry Ford’s first Model T was made with hemp acrylic skin & upholstery and ran on hemp ethanol).

- Hemp fibre was competition for DuPont’s synthetic petroleum-based plastics.

Since its unbanning, investors have taken interest. There is now both a Canadian and US Marijuana Index and various cannabis focussed companies publicly listed, including Aurora Cannabis (ACB), Canopy Growth Corp (CGC: NYSE, WEED: Toronto) and Cronos Group Inc. (CRON). Even the traditional beer and tobacco companies have taken interest, purchasing minority stakes and co-developing new products, such as cannabis-infused drinks.

It is difficult to value these businesses as they are still mostly cash flow and earnings negative and are rapidly issuing new shares to fund growth. However, a quick “back of the matchbox” calculation shows most of these companies to be significantly overvalued. Investor caution is required.

Whilst the Fintax Funds do not have direct exposure to any cannabis focussed companies, they do have exposure to various healthcare companies which in turn are cautiously entering the wider cannabis market. One of them is CVS Health Corp owned in the Veritas Global Focus Fund. It has recently started to sell products that contain CBD, the non-psychoactive ingredient derived from hemp used for the treatment of pain, anxiety, depression and heart disease.