We are currently experiencing the second longest lasting bull market in history (with the longest being the 1987 – 2001 bull market). With market prices, in general, being elevated relative to their underlying value, the London team are placing increased emphasis on capital protection within the Fintax Funds.

The strong value underpinning within the Fintax Funds, relatively high levels of cash, both at an asset allocation level and within the underlying funds, help to serve as protection against market corrections. You will recall that the funds also have various liquid alternatives in place, largely uncorrelated to equity markets, as well as put options on the S&P500 covering 5% of each fund’s equity carve-outs.

As with all bull markets, certain listed businesses are latched onto by the media, and by implication become the market darlings, further fuelling their market prices. A good example of a particularly overvalued market darling, in the current bull market, is Tesla (specifically not held in the Fintax Funds, due to it being overvalued).

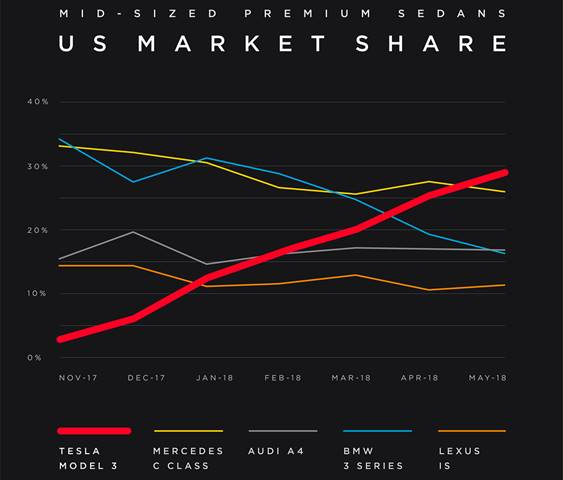

The carmaker has been a rollercoaster ride the past month. Not only was the Tesla Model 3 announced as the best-selling luxury sedan in the US, it was also announced by Elon Musk (Tesla CEO) that he will be laying off 9% of Tesla’s staff due to increased automation, and consequently some duplication in workload.

Just a day after this announcement Mr. Musk bought $25m worth of Tesla stock, helping to prop up the share price. Mr. Musk would want the share price to be as high as possible. Tesla currently carries around $10bn of debt on its balance sheet and is struggling to raise new financing to help fund the production of its cars. A big portion of this debt is convertible meaning that these debt instruments get converted from debt to equity at maturity, at a conversion price of $360. Should Mr. Musk manage to further prop up the already overvalued price ($356) of Tesla stock, the conversion of these instruments will go some way to partially relieve Tesla’s funding pressure. Fortunately, neither Fintax Fund is currently invested in any Tesla instrument (debt or equity) so is not exposed to the risks involved in holding such an overvalued, risky business.

Contrast Tesla to Bed, Bath & Beyond, a holding in the Contrarius Global Equity Fund, which is held within the Fintax Funds. Like Tesla it provides a compelling offer to consumers. Unlike Tesla, Bed Bath & Beyond generated significant cash flow over the past 12 months, has a strong balance sheet and the financial flexibility to continue to invest in its product line, without the need to raise any external funding. It is also trading at a significant discount to the Contrarius estimate of its fair value, providing a value underpinning within the Fintax Funds.